Do Nothing

When you think about it, there are only three ways to make investment decisions: securities selection, market timing and asset allocation. Securities selection implies that the investor uses a particular process by which they eliminate all the bad investments and select the good investments-the investments that will outperform everything. Market timing implies that the investor gets in or out of the market to avoid losses and capture gains.

Securities selection and marketing timing requires lots of activity: ‘there’s a better investment, so sell the old one and buy a new one’; ‘market indicators are poor so better get out of the market and when things look better, get back in’. It’s exhausting. And it doesn’t work.

Asset allocation implies a diversified portfolio with a given amount of return for a given amount of risk and the risk of the portfolio correlates with the risk of the investor. Other than re-balancing or qualitative improvements, it’s not nearly has active as securities selection and market timing. It’s passive. And it works.

Behavioral economics is the study of humans (psychology) and financial decisions (investing). These studies clearly show the problems of humans believing that they have superior knowledge and skills to select the best investments or to successfully time the financial markets. Yet time and time again, even the professionals succumb to psychological biases. Behavioral finance implies that investors should do little and don’t think too much. Which is why asset allocation works.

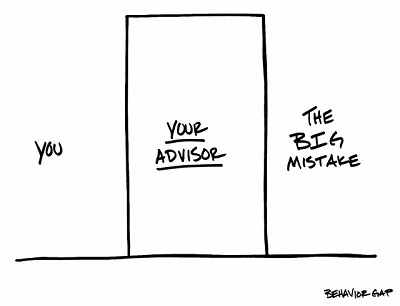

The best financial advisers keep their clients from making big mistakes like securities selection and market timing. Sometimes that means to do nothing, nothing at all.